All Categories

Featured

Table of Contents

Prostock-Studio/ GOBankingRates' editorial team is devoted to bringing you objective testimonials and information. We make use of data-driven approaches to evaluate monetary items and services - our evaluations and scores are not affected by advertisers. You can learn more regarding our content guidelines and our products and services review method. Infinite banking has actually recorded the passion of lots of in the individual money globe, promising a path to financial freedom and control.

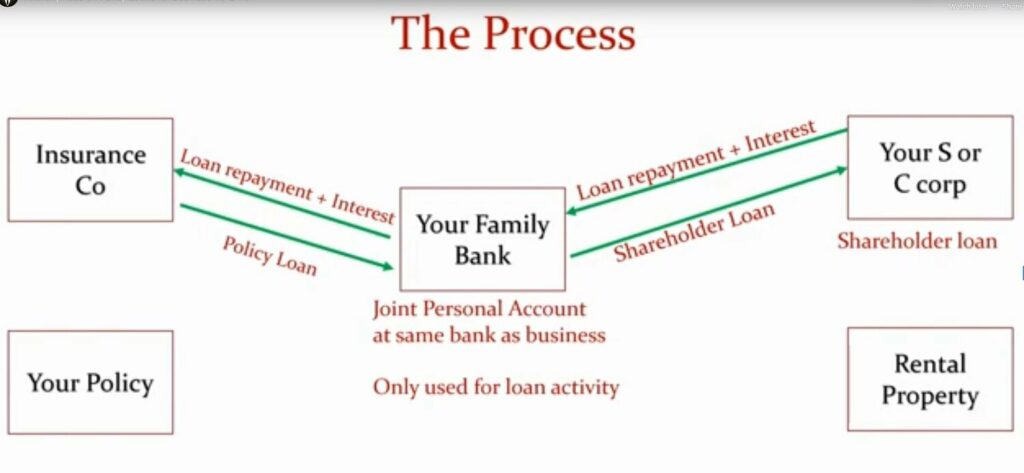

Limitless financial refers to an economic approach where a private becomes their very own banker. The insurance holder can borrow against this cash worth for various economic requirements, successfully loaning money to themselves and settling the policy on their very own terms.

This overfunding speeds up the development of the plan's money value. The policyholder can after that borrow against this cash worth for any objective, from financing an auto to buying property, and after that settle the car loan according to their very own routine. Limitless financial provides many benefits. Here's a check out a few of them. Infinite Banking retirement strategy.

Life Insurance Loans

Right here are the response to some inquiries you may have. Is infinite banking legit? Yes, limitless financial is a legit approach. It involves using an entire life insurance policy policy to develop an individual funding system. Its efficiency depends on different factors, consisting of the plan's framework, the insurance coverage firm's efficiency and just how well the method is taken care of.

For how long does infinite financial take? Boundless banking is a long-term approach. It can take numerous years, commonly 5-10 years or even more, for the money value of the plan to grow sufficiently to begin obtaining against it effectively. This timeline can vary depending upon the plan's terms, the premiums paid and the insurance firm's efficiency.

How secure is my money with Policy Loans?

Long as premiums are present, the insurance holder simply calls the insurance firm and requests a car loan against their equity. The insurance provider on the phone will not ask what the finance will certainly be used for, what the revenue of the borrower (i.e. insurance policy holder) is, what other properties the person may have to act as security, or in what duration the person intends to pay back the funding.

In comparison to describe life insurance policy items, which cover only the recipients of the policyholder in the occasion of their fatality, entire life insurance covers an individual's entire life. When structured correctly, entire life plans generate an one-of-a-kind earnings stream that raises the equity in the policy in time. For further analysis on just how this works (and on the advantages and disadvantages of entire life vs.

In today's globe, one driven by comfort of usage, also numerous consider granted our country's purest founding concepts: freedom and justice. Lots of people never ever stop to take into consideration how the items of their bank fit in with these virtues. So, we position the straightforward inquiry, "Do you really feel liberated or justified by running within the constraints of business credit lines?" Click below if you 'd such as to discover an Accredited IBC Expert in your location.

How do I optimize my cash flow with Self-financing With Life Insurance?

Reduced funding rate of interest over policy than the traditional finance products get collateral from the wholesale insurance plan's cash money or surrender value. It is a principle that allows the insurance holder to take car loans on the whole life insurance policy policy. It must be offered when there is a minute economic worry on the person, where such fundings may aid them cover the financial lots.

The policyholder requires to link with the insurance coverage firm to request a funding on the policy. A Whole Life insurance coverage plan can be labelled the insurance coverage item that provides defense or covers the person's life.

It begins when a private takes up a Whole Life insurance policy. Such plans maintain their values since of their traditional technique, and such plans never ever spend in market tools. Infinite banking is an idea that allows the policyholder to take up car loans on the entire life insurance plan.

How can Self-financing With Life Insurance reduce my reliance on banks?

The money or the surrender value of the entire life insurance policy works as collateral whenever taken lendings. Expect an individual enrolls for a Whole Life insurance policy policy with a premium-paying regard to 7 years and a plan period of 20 years. The individual took the plan when he was 34 years old.

The car loan rate of interest price over the policy is fairly reduced than the conventional lending products. The security acquires from the wholesale insurance plan's money or abandonment value. has its share of advantages and downsides in terms of its basics, application, and performances. These factors on either extreme of the spectrum of facts are reviewed listed below: Boundless financial as a monetary technology boosts capital or the liquidity profile of the policyholder.

Who can help me set up Infinite Wealth Strategy?

In monetary situations and hardships, one can make use of such items to use loans, thereby minimizing the trouble. It supplies the most affordable finance cost compared to the standard lending product. The insurance coverage funding can likewise be readily available when the person is jobless or encountering wellness concerns. The entire Life insurance coverage policy retains its total value, and its performance does not link with market efficiency.

Typically, acts well if one entirely depends on banks themselves. These principles benefit those that possess solid financial cash flows. Additionally, one need to take just such policies when one is economically well off and can take care of the policies premiums. Unlimited financial is not a rip-off, but it is the most effective point lots of people can select to enhance their economic lives.

How do I leverage Cash Value Leveraging to grow my wealth?

When individuals have boundless financial explained to them for the very first time it looks like a magical and safe means to grow wealth - Private banking strategies. The idea of changing the disliked financial institution with loaning from yourself makes a lot even more feeling. But it does require changing the "disliked" financial institution for the "hated" insurance provider.

Of course insurance policy firms and their agents enjoy the principle. They created the sales pitch to sell more entire life insurance coverage.

There are two major monetary calamities constructed right into the boundless banking principle. I will expose these flaws as we function through the mathematics of how limitless banking really functions and just how you can do a lot better.

Latest Posts

Infinite Banking Strategy

Be My Own Bank

Infinite Concepts Scam